‘Funding can quickly become

a very complex topic’

Graham Friend, Stefan Zehle

Guide to Business Planning (2009, 223)

COSME at a glance

COSME is the main financial instrument of the EU aimed at sustaining Small and Medium-sized Enterprises (SMEs), according to the comprehensive policy framework for SMEs established in:

- the Communication “Think Small First – A Small Business Act for Europe” (25 June 2008), which established the Small Business Act (the SBA was updated in 2011),

- the Communication “An Integrated industrial policy for the globalization era. Putting competitiveness and sustainability at centre stage” (28 October 2010), which established one out of seven Flagship Initiatives of the “Europe 2020” strategy,

- the Communication “For a European Industrial Renaissance” (22 January 2014).

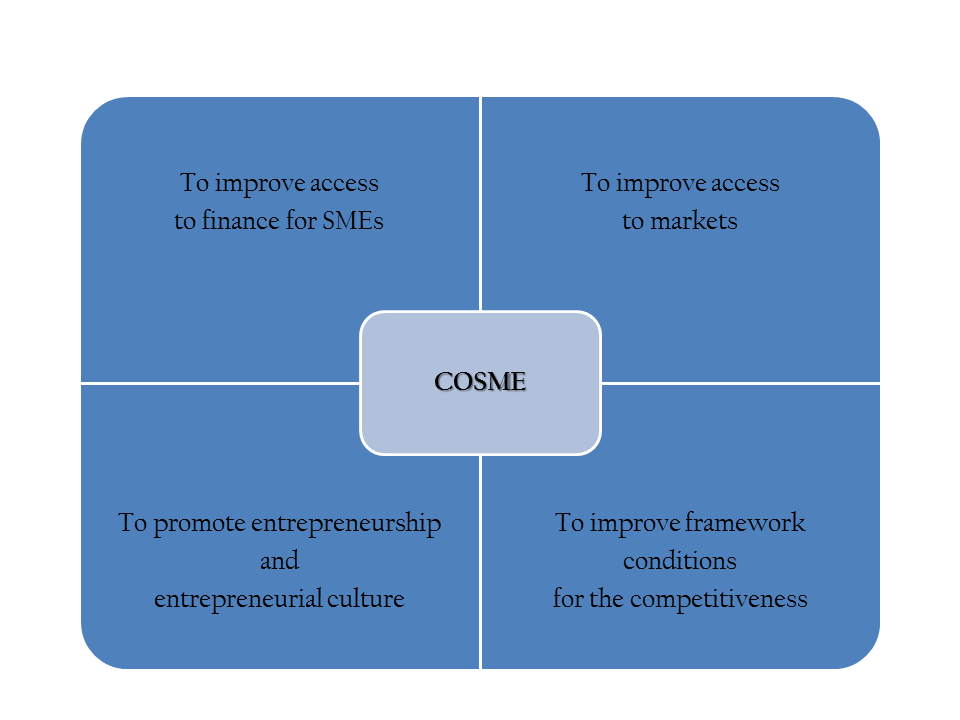

As it can be seen in the following chart, the Programme has 4 overarching objectives.

Chart 1. Objectives of the COSME Programme

This post deals with the most important objective under a financial perspective, that is “to improve access to finance for SMEs in the form of equity and debt”, which accounts for 60% of the total financial envelope of the Programme.

The financial instruments EFG and LGF

In the aftermath of the financial crisis, that started in the US and later spread to the EU, SMEs have increasingly had difficulty accessing risk capital (equity) and loans (debt finance).

Accordingly, Art. 5 of Reg. (EU) No 1287/2013 establishes that at least 60% of the COSME’s budget has to be devoted to easing access to equity and debt finance, “with the aim of facilitating access to finance for SMEs, in their start-up, growth and transfer phases” (art. 17 of the Regulation establishing COSME).

Financial instruments under the COSME Programme include:

- an equity facility, named Equity Facility for Growth – EFG (art. 18 of the COSME regulation),

- a Loan Guarantee Facility – LGF (art. 19 of the COSME Regulation).

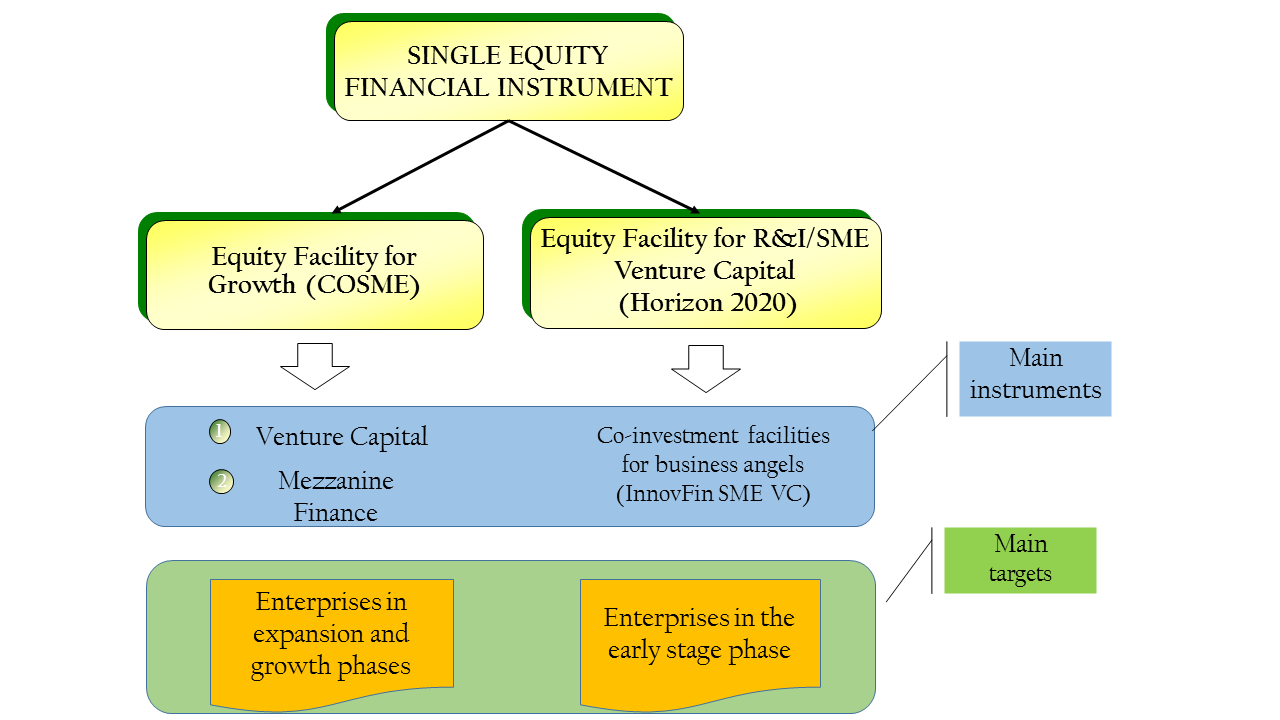

The Equity Facility for Growth (EFG) shall be implemented as a window of a single European equity financial instrument, which supports SMEs growth and their research and innovation activities since the early-stage phase of the enterprise life cycle.

The EFG under the COSME Programme aims primarily at enterprises in the expansion and growth phase.

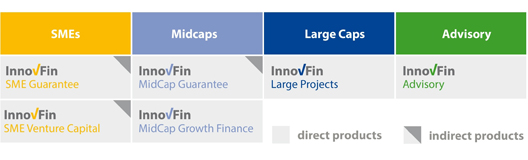

The InnovFin SME Venture Capital under Horizon 2020 equips enterprises with early-stage finance (especially seed and start-up finance). This instrument is part of InnovFin, a series of integrated financing tools and advisory services managed by the European Investment Bank Group (EIB and EIF) under Horizon 2020 (see the chart below).

Chart 2. InnovFin – Instruments

Source: European Investment Bank Group

The following chart summarises the main features of the European equity financial instrument.

Chart 3. Main features of the European equity financial instrument

The Loan Guarantee Facility is part of the Single Debt Financial Instrument for EU enterprises’ growth and Research and Innovation. Accordingly, it provides SMEs with guarantees and co-guarantees in conjunction with InnovFin SME Guarantee for R&I under Horizon 2020.

Specifically, it provides:

- Direct guarantees on debt financing and other risk sharing arrangements for any other financial intermediaries.

- Counter-guarantees and other risk sharing arrangements for guarantee schemes including, where appropriate, co-guarantees (see art. 19 of the COSME Regulation).

Both the EFG and the LGF are managed by the European Investment Fund (EIF) and are demand-driven instruments, id est the allocation of funds is based on the demand expressed by financial intermediaries.